Common Questions

1. What is meant by market value of a property? How is stamp duty fixed?

A property may command a particular rate in the open market. This is called its market value. Stamp duty can either be based on the property's market value or on its agreement value. Generally, stamp duty is fixed according to whichever is greater.

2. What is property valuation?

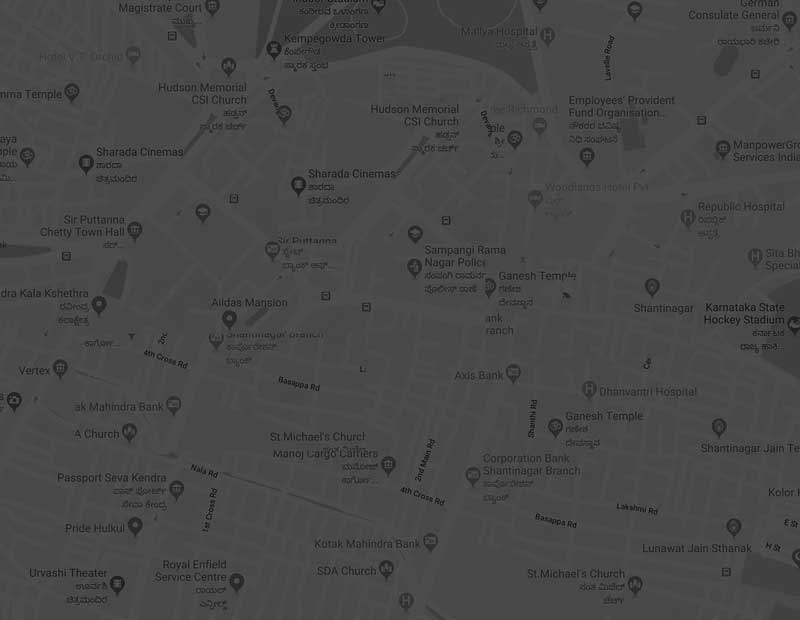

Many factors must be taken into consideration before the market value of a property is fixed. Some of these are: The property type, the location, the quality of the construction and specifications, the infrastructure provided, and the maintenance levels. More important is the factor of supply and demand. After taking all these into account, the valuation process is complete.

3. What is the benefit of valuation of a property?

When real estate agents are asked to evaluate a property, they generally do so basing it on arbitrary information of recent transactions of similar properties in the vicinity. This, while offering a broad-spectrum idea of the market value, is not as precise as an official valuation. For instance, in case one needs to pledge the property against a loan, the loan approval process is quicker and easier if the property is certified by an official evaluator. Many banks demand valuation certificates before issuing loans against properties. Another advantage of official evaluation is that you may be sanctioned a higher loan amount.

A certification is also necessary when the precise value of the property has legal connotations, as in the case of will statements, property insurance, balance sheets, etc. A final benefit of official evaluation is that it becomes a handy negotiating tool on resale of the property.

4. What do the terms 'Leasehold Property' and 'Freehold Property' mean?

When a piece of property is given out or 'leased' to an individual (the 'Lessee') for a stipulated period of time by the 'Lessor' or owner, this is referred to as Leasehold Property. As a lease premium, a certain amount is fixed by the Lessor. The ownership rights to the property remain with the Lessor.

When ownership right to a property is given to a purchaser in consideration of a sum of money, this property is referred to as 'Freehold Property'. Unlike leasehold property, no annual or lease charges need be paid, and the freehold property may be re-registered and/ or transferred to the new owner.

5. What, if any, are the advantages in converting a leasehold to a freehold?

The benefits are several: if one gets a leasehold property converted to a freehold one, one becomes a full-fledged owner, taking possession of the sale deed and getting it registered. A freehold property has more marketability and can be sold, mortgaged or pledged as standing security, which is not possible in the case of leasehold property.

6. What are the income tax implications while transferring newly acquired property?

If the property is transferred within three years from the date of purchase, income tax exemption under Section 54F of the Income Tax Act is not applicable. Tax would therefore have to be paid.

7. How is a property sale concluded?

An agreement of sale document, accompanied by actual possession of the property by the buyer, marks the conclusion of a sale. Usually, the entire amount agreed upon is handed over at the time of possession.

Pertaining to Residences

1. What is the meaning of the terms carpet area, built-up area and super built-up area?

The area of an apartment or building, excluding the area occupied by the walls, is known as the carpet area of the property. This is the area actually used, wherein a carpet can be laid. When the area of the walls, including the balcony, is added to the carpet area, this forms the built-up area. Finally, the built-up area including the area of the common spaces like lobby, lifts, stairs, garden and swimming pool is known as the super built-up area.

2. With apartments of different sizes in a residential complex, how would maintenance charge be fixed?

The actual area owned by an individual is legally the basis for calculating maintenance charges.

3. What is a Sinking Fund, and why do Co-operative Housing Societies collect it from owners?

A Sinking Fund is a contingency fund, collected so that if the building needs repairs, reconstruction, structural additions or alterations in the future, the society can use it for this purpose. All Co-operative Housing Societies are required by law to collect a Sinking Fund. The General Body fixes the amount to be contributed by each owner, usually at least 1/4 percent per annum of each apartment's cost. This excludes the cost of the land. The fund may be utilized on a resolution being passed at the General Body meeting, and with prior permission of the Registering Authority.

4. How is a lease agreement created?

Depending on the particular case, a lease agreement can be reached in one of two ways:

Where the lease contract is from year-to-year/ exceeding one year's rent/ reserving yearly rent, then a registered instrument can be created, which both lessor and lessee must execute.

In all other cases, an oral agreement followed by delivery of possession is generally considered sufficient.